Plan for college without compromising FIRE

Supporting your kids' future shouldn't mean sacrificing your own. MOF helps you do both.

Build My PlanCollege costs are rising—and they hit right before you FIRE

Paying for college is one of the biggest financial goals families face. But here’s what makes it uniquely tricky:

- It’s expensive—and growing 5–6% every year

- Balancing with FIRE is challenging

- It often hits right before or around your FIRE date

You can’t afford to ignore it—and you can’t let it blow up your FIRE plan.

But most people don’t know:

- How much they’ll need in the future

- How much to save monthly

- Whether they’re on track with what they’ve already saved

- How to balance college with their own financial independence

So they either delay FIRE, underfund college, or wing it.

This isn’t just a savings problem. It’s a timing, tax, and inflation problem—one most calculators and spreadsheets oversimplify.

MOF makes college planning part of your FIRE plan — Not an obstacle

We built MOF to take the stress and guesswork out of funding college. Here’s how it works:

- Estimates future costs accurately: MOF projects tuition costs based on your child’s age, public vs private school preference and education inflation.

- Accounts for what you’ve already saved: Whether you’ve got $5K or $50K in a 529, MOF factors it in before suggesting any new contributions.

- Calculates monthly/annual contributions to fill the gap: MOF reverse-engineers exactly what you need to contribute monthly to fully fund college by the time your child enrolls.

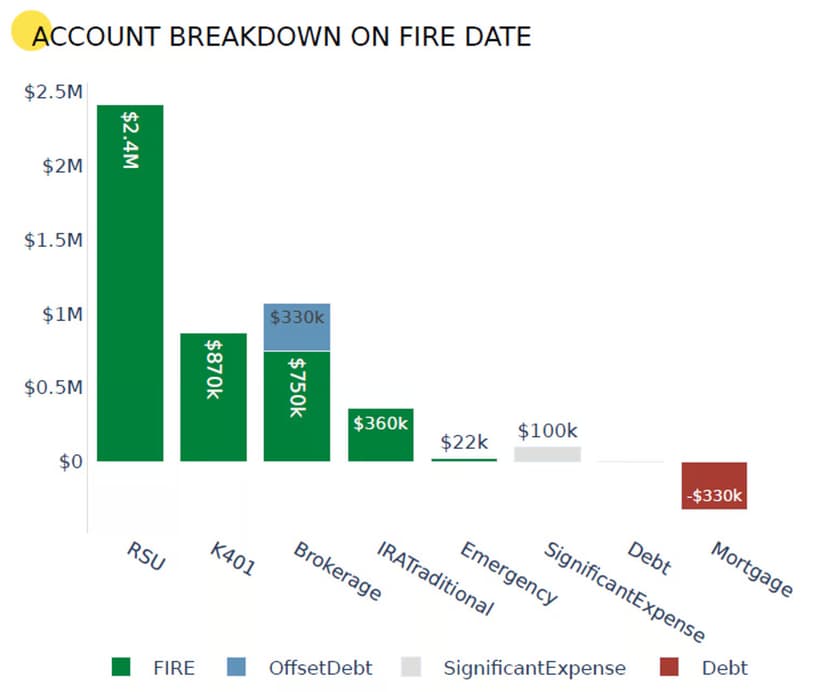

- Weaves it into your FIRE Plan automatically: Instead of handling college separately, MOF interleaves it with your other financial priorities—retirement accounts, emergency funds, debt, and more.

- Optimizes use of 529 plans: MOF recommends how much and when to contribute to tax-advantaged 529 accounts for maximum benefit.

Make room for their future—and yours

MOF helps you support your kids' education and still reach financial independence.

Start my college plan