Your Complete Roadmap toFinancial Independence

Plug in your numbers. Get a clear, actionable plan to reach FI faster.

Managing your finances is too hard

The Complexity is Real

RSUs vesting, 401(k) mega backdoors, Roth conversions, investment properties, 529s for the kids — and you're supposed to optimize all of this while doing your actual job? You want to reach FI, not become a tax accountant.

Spreadsheets Fall Short

Your DIY spreadsheet was a great start, but it can't model tax brackets, account contribution limits, or how your RSU vest schedule interacts with your other income. It quickly becomes outdated and unreliable.

Optimization Left on the Table

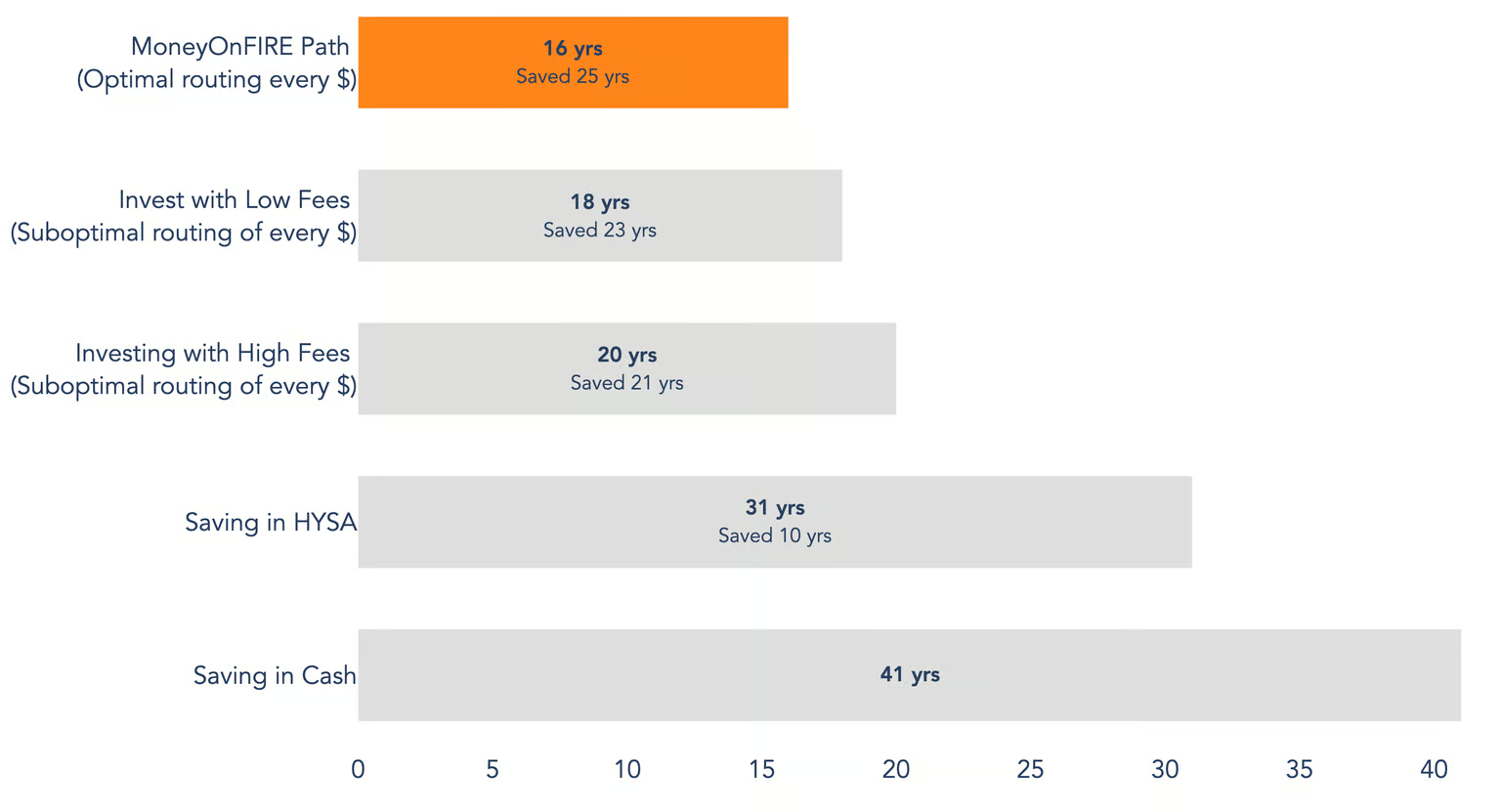

Without the right strategy, you could be leaving years on your FI journey. The difference between a good plan and an optimized one can be hundreds of thousands of dollars and years of your life.

Your Path to FI, Mapped Out

MoneyOnFIRE solves the complexity: goals, taxes, different accounts, debts, inflation. It calculates a personalized path tailored to your unique situation and gives you clear, step by step actions to implement.

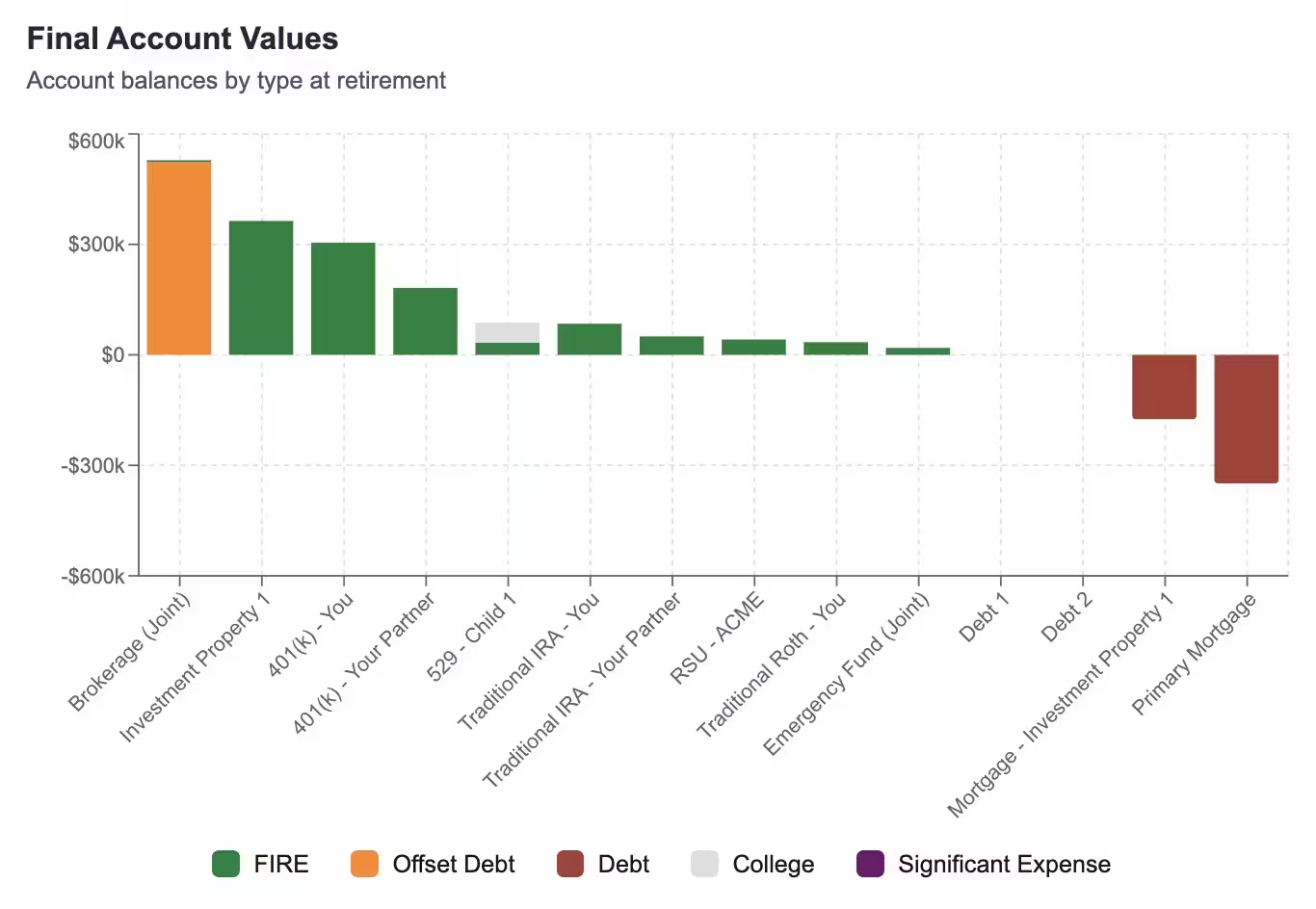

Your Personal FI Number

MOF calculates your exact target across all account types — adjusting for taxes, inflation, and your specific goals. No guesswork, no rules of thumb. Just one clear number personalized to you.

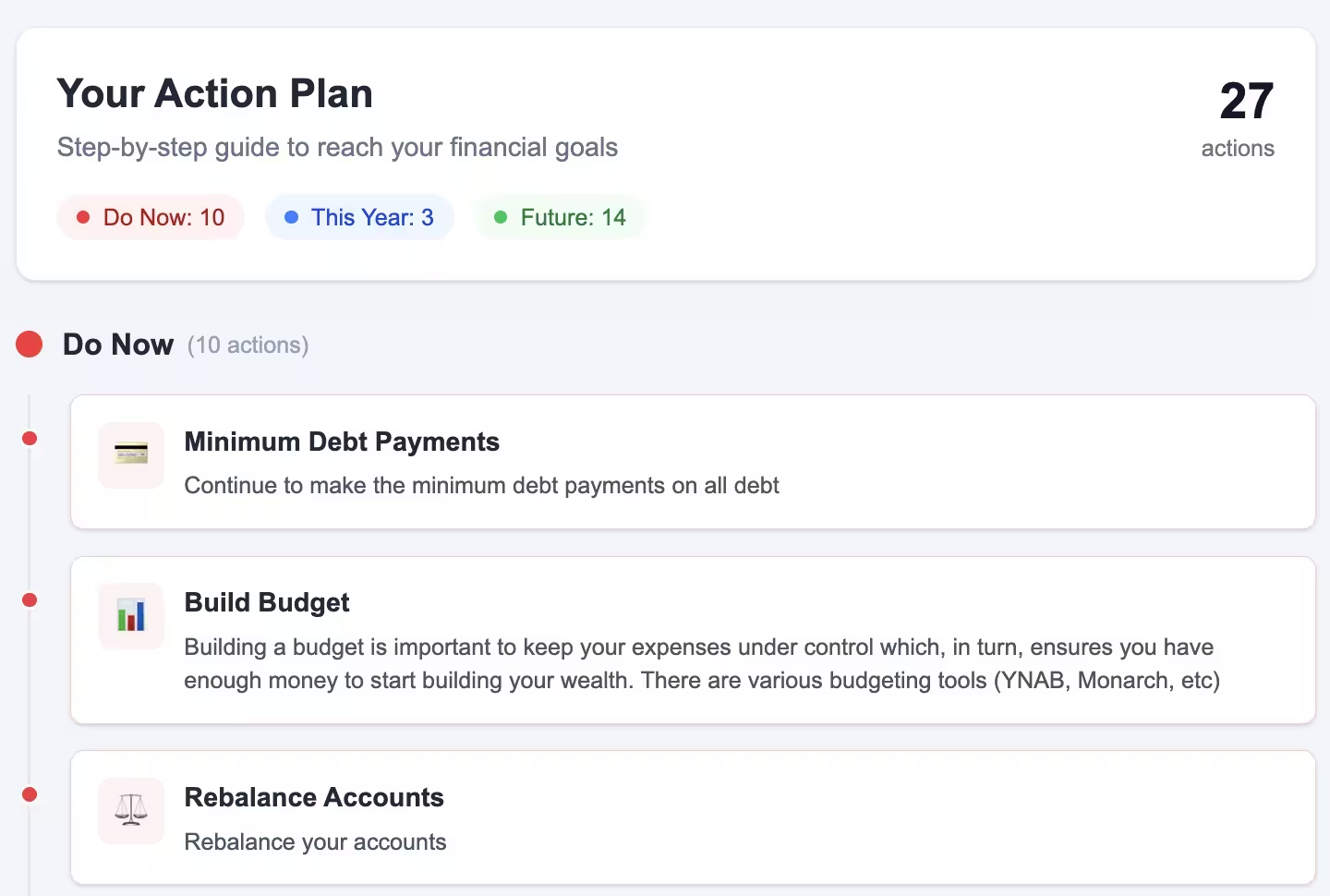

Month-by-Month Roadmap

Know exactly what to do with every dollar, every month. Our detailed guidance shows you precisely where to allocate income across accounts, debts, and goals — no more guessing.

Comprehensive Planning

Taxes, RSUs, 401(k)s, IRAs, 529s, investment properties, debts — we handle it all. See your complete financial picture in one unified view, with every account and goal working together.

Reach FI Faster

We optimize for speed. Our engine finds the fastest path to financial independence by analyzing tradeoffs across tax strategies, account types, and contribution timing.

How it works

5 Minutes to Enter Your Info

Answer a few quick questions about your income, accounts, debts, and goals. We keep it fast and focused on what matters.

We Handle the Complexity

Our engine optimizes across RSUs, 401(k)s, investment properties, 529s, debts, and taxes — calculating the fastest path to your goals.

Get Your Month-by-Month Plan

Receive a personalized roadmap showing exactly what to do with every dollar, every month — from now until you reach FI.

What our users are saying

"Financial Independence used to feel like a distant dream. MOF changed that. It gave me clarity, confidence, and the ability to shape my plan with ease. For the first time, early retirement feels real."

"I wish I had this tool when I started my Financial planning. It is super comprehensive. I highly recommend this to anyone thinking about financial independence."

"I was excited by FI but it seemed too unachievable and hard. I felt like I needed a Masters in Finance just to work out how much I needed, let alone navigate how to get there. MoneyOnFIRE made it super easy to do both"

"MoneyOnFIRE helped us go from overwhelmed spreadsheets to a clear Financial plan. Now we know exactly when we can retire – and afford college too."

"The account optimization blew my mind. I had no idea I was putting money in the wrong places."

"I loved seeing how different spending scenarios affected my goals. This gave me confidence to cut back work and still stay on track."