Don't let inflation derail your FIRE plan

Ignoring inflation means chasing the wrong number—and possibly running out of money.

Accelerate your journeyInflation makes FIRE a moving target

Let's say you need $80K/year to retire comfortably today. Using the simple 4% rule, that puts your FIRE number at $2 Million.

That number feels right. You might think: "Once I hit $2M, I'm done."

But here's the problem: Most people don't FIRE immediately—they're working toward that number over 5, 10, even 15 years. And during that time, inflation keeps moving the goalpost.

Let's say it takes 10 years to reach your $2M goal. You will still generate $80K/year. But that will feel more like $59K/year in today's dollars. You will end up with 24% less purchasing power than you expected.

That's a huge gap—and it can mean compromising your lifestyle or, worse, going back to work.

Why this happens:

Inflation is the rise in prices over time. It chips away at what your money can buy. A Coke that cost $1.00 a decade ago might cost $1.65 today. Now apply that to your rent, groceries, healthcare, and everything else.

And here's the kicker: Most FIRE tools and spreadsheets ignore inflation—or apply it inconsistently.

MOF keeps your FIRE number real

We have primarily discussed inflation for FIRE expenses impacting the FIRE goal. However, inflation impacts everything - it impacts expenses, it also impacts various tax bands and thresholds. Our engine automates all of this in.

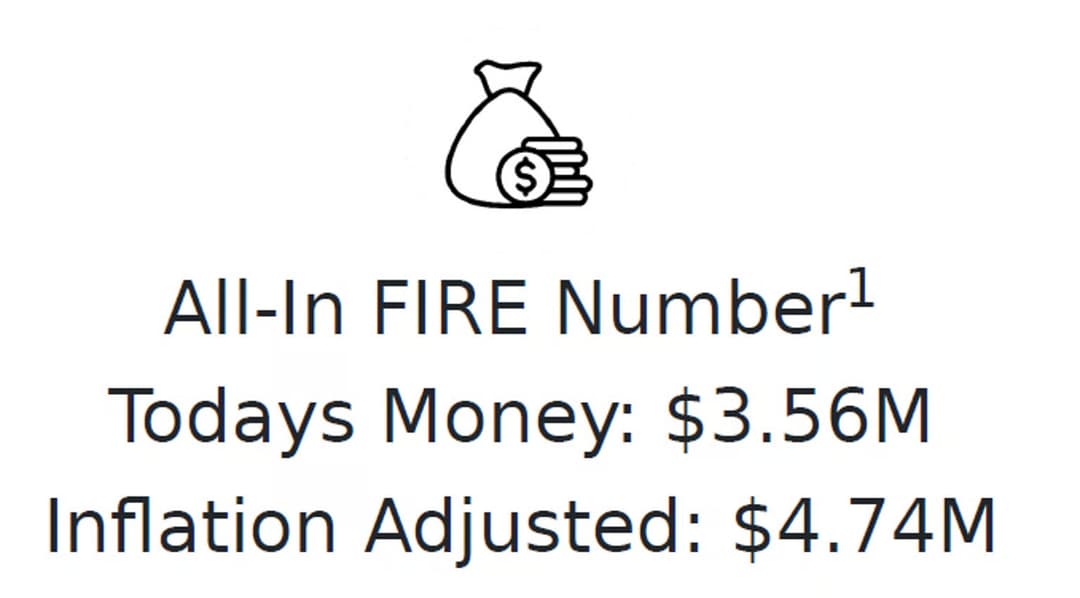

- Inflation-adjusted FIRE number: Our engine automatically calculates your FIRE target every year, based on your expenses, taxes and inflation.

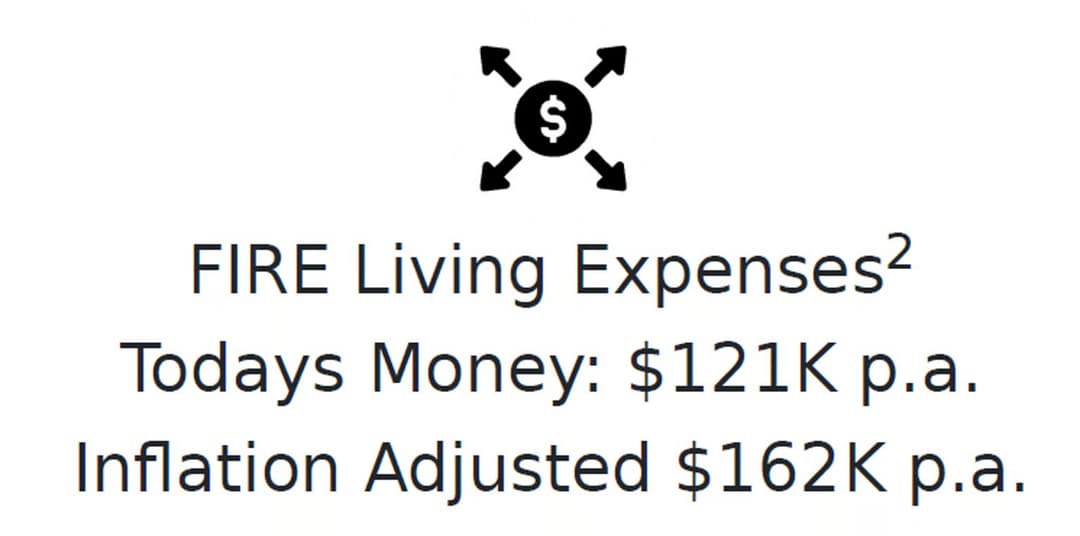

- Inflation-adjusted expenses: We factor inflation into everything:

- Living costs

- College tuition

- Tax brackets

- Other large expenses like weddings or travel

- Different rates: We apply different rates for different categories e.g. college costs are growing more than expenses

- Dual-dollar view: We show your plan in both today's dollars and future value, so you always understand what's real

- Integrated timeline: We adjust every year of your plan dynamically to check when you can reach FIRE on an inflation-adjusted basis

FAQ

Q: How does MOF decide what inflation rate to use?

A: We start with 5.2% for college inflation and 2% for everything else. In future versions, you'll be able to tweak both based on your expectations or market conditions.

Q: Do all expenses get adjusted for inflation?

A: Yes—your living expenses, housing, college costs, all grow at different inflation rates, and MOF accounts for that.

Don't let inflation be your blind spot

You wouldn't build a retirement plan that ignores taxes—don't ignore inflation either. MOF grounds your plan in the real world, not just today's numbers.

Build an Inflation-Smart FIRE Plan