Smarter RSU decisions—built into your FIRE plan

Sell, hold, or both? MoneyOnFire gives you answers, not guesswork.

Build My PlanRSUs are powerful—but complicated

Restricted Stock Units (RSUs) are a common part of compensation in tech and high-growth companies. They're exciting—but they’re also confusing:

- They vest = You owe taxes

- You sell = You trigger capital gains

- You hold too long = You take unnecessary risk

- You forget about tax implications = You stress about taxes

- Hold or sell? = You receive generic advice like “just diversify”

The result? Most people either sell too soon, hold too long, or don’t know how RSUs fit into their broader plan. That leads to:

- Surprise tax bills

- Overexposure to a single company

- Missed opportunities to fund goals like FIRE

Spreadsheets rarely factor RSUs in correctly—especially across vesting schedules, taxes, and priorities. And traditional tools just ignore them entirely.

MOF integrates RSUs into your FIRE strategy

At MoneyOnFire, we treat RSUs not just as compensation, but as a core financial decision—and we handle the complexity so you don’t have to.

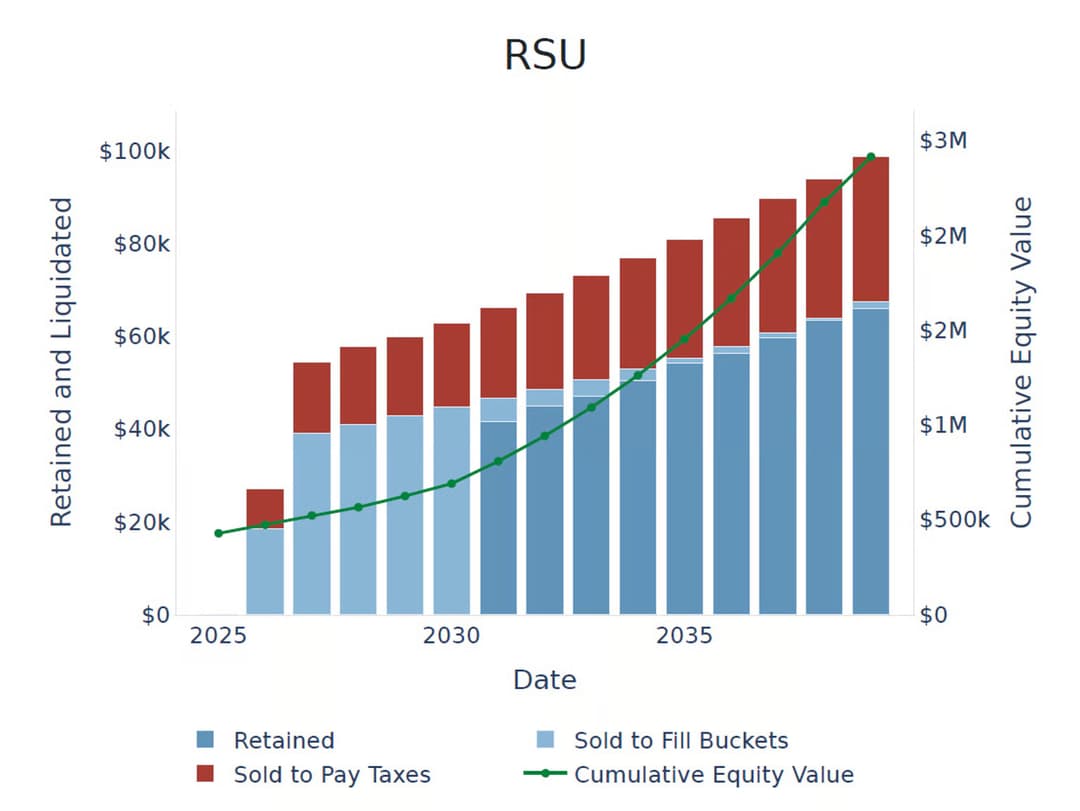

- Covers your tax bill first: When RSUs vest, we ensure you’re not hit with an unexpected tax burden by selling a portion just to handle taxes.

- Funds high-priority goals automatically: After taxes, we check if your RSUs can fund things like emergency funds, debt payoff, or IRA contributions.

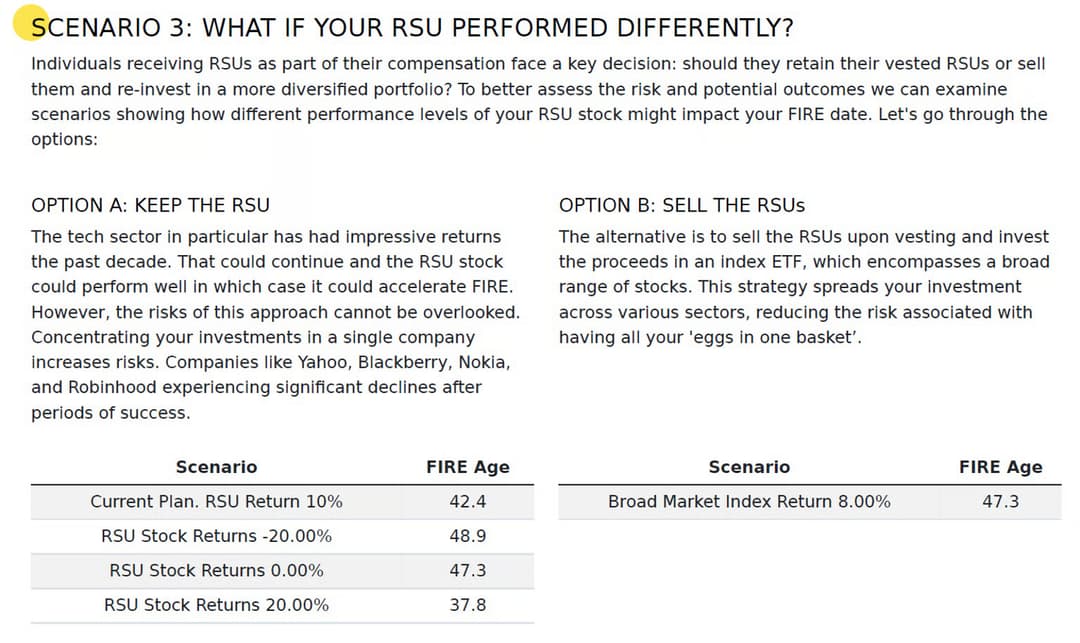

- Flexible sell-or-hold modeling: We run what-if scenarios for selling vs. holding, and let you choose based on risk comfort.

- Integrated: RSUs are woven into your FIRE plan—not bolted on. You see their impact on your FIRE date and savings path.

Make better RSU decisions with MoneyOnFire

Don’t let taxes or risk derail your FIRE journey. Turn RSUs into progress.

Start my RSU plan